New rules on super payments

Taking on a new worker is always an exciting time for employers and employees. For the employer, it reflects business growth and planning, while for the employee, it’s an opportunity for a fresh start in a new role with new responsibilities.

However, there are things to be aware of as you both begin your employment journey, and one of them is around employer contributions to superannuation.

Super stapling…what the?

Essentially, on 1 November 2021, new rules came into effect to reduce the chance of employees accumulating multiple super accounts when moving from one job to another. Employees will now become ‘stapled’ to their existing super accounts.

And while we don’t foresee the ATO knocking on your door with the latest stapler offering from Officeworks, it does mean that if a new employee doesn’t nominate a super fund, their employer [you] must pay super contributions into their existing account [stapled fund].

So, how does it work?

Currently, if you’re a business, you must offer your staff a choice of super fund to meet their superannuation obligations. You do this by providing your new employees with a superannuation Standard Choice form (either a hardcopy or through the ATO via myGov) within 28 days of them starting at your company.

As of 1 November 2021, if your new staff member doesn’t nominate a fund, you [as an employer] must use an ATO database to check if they have an existing [stapled] fund. If a stapled fund exists, super contributions must be paid into that fund.

Where a new employee hasn’t selected a fund and doesn’t have a stapled fund, super contributions must be made to a new account in your workplace default super fund.

Why is the ATO doing this? Mainly because having more than one super account can be costly for employees, as it means paying multiple sets of fees and insurance premiums.

What’s it mean for employees?

Your employees will always have the option to change super funds whenever they want. Should that happen, their new nominated fund will become their stapled fund. However, they still need to notify you if they do change.

Additionally, if your new employee has more than one fund, the ATO will automatically staple them to the one that’s been most active (i.e., received a contribution recently). Where there’s more than one active fund, rules are applied to select the most appropriate [e.g., the fund with the most significant balance].

Do I need a default or preferred fund?

Essentially, yes. Chiefly for any new staff member who is not already a member of a superannuation fund. As an employer, you’re obligated to offer them a choice of funds. However, if they don’t choose a fund, they are then signed up to the company’s default fund, which then becomes their stapled fund.

Checklist for employers

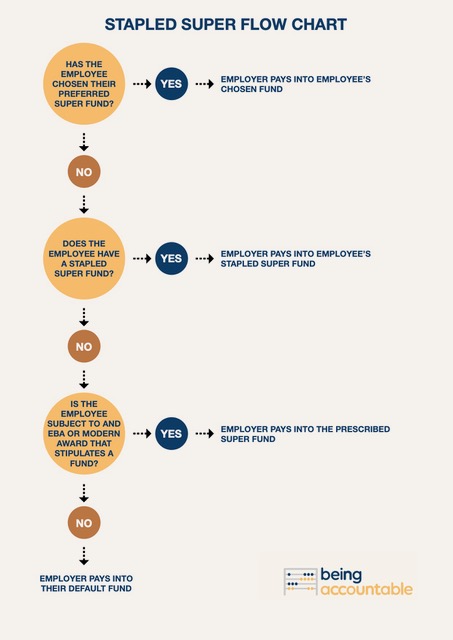

As a quick recap, here’s a simple flow chart to consider when onboarding a new employee.

These changes don’t affect your obligation as an employer to nominate a default super fund to pay your employee’s super into if they have not chosen a fund and don’t have a stapled fund.

While it may seem a bit complex, it’s actually a pretty straightforward process. Your bookkeeper and HR team should be all over this. If they’re not, a simple call to Being Accountable will have you on the right track.

Call Being Accountable on (08) 0402 464 420 and Let Jo and her ‘super’ team advise you on your super obligations — stapled or otherwise.